Long before nations, corporations, and stock markets came into being, human beings throughout history have been asking themselves these timeless questions:

How much protection do we need? And how much should we trust in freedom?

Ancient philosophers such as Plato and Aristotle had thought about these issues. Later, political philosophers such as Hobbes and Locke had provided the initial frameworks for this dilemma. The pessimistic Hobbes had imagined life without an overarching authority as chaos, while the more optimistic Locke insisted that liberty was essential for trust and progress. But centuries later, their debate is still alive and well, not just in the political science departments of universities, but also outside the academy; this perennial debate is at the core of how societies are governed, how people go about their work, and how we invest for the future.

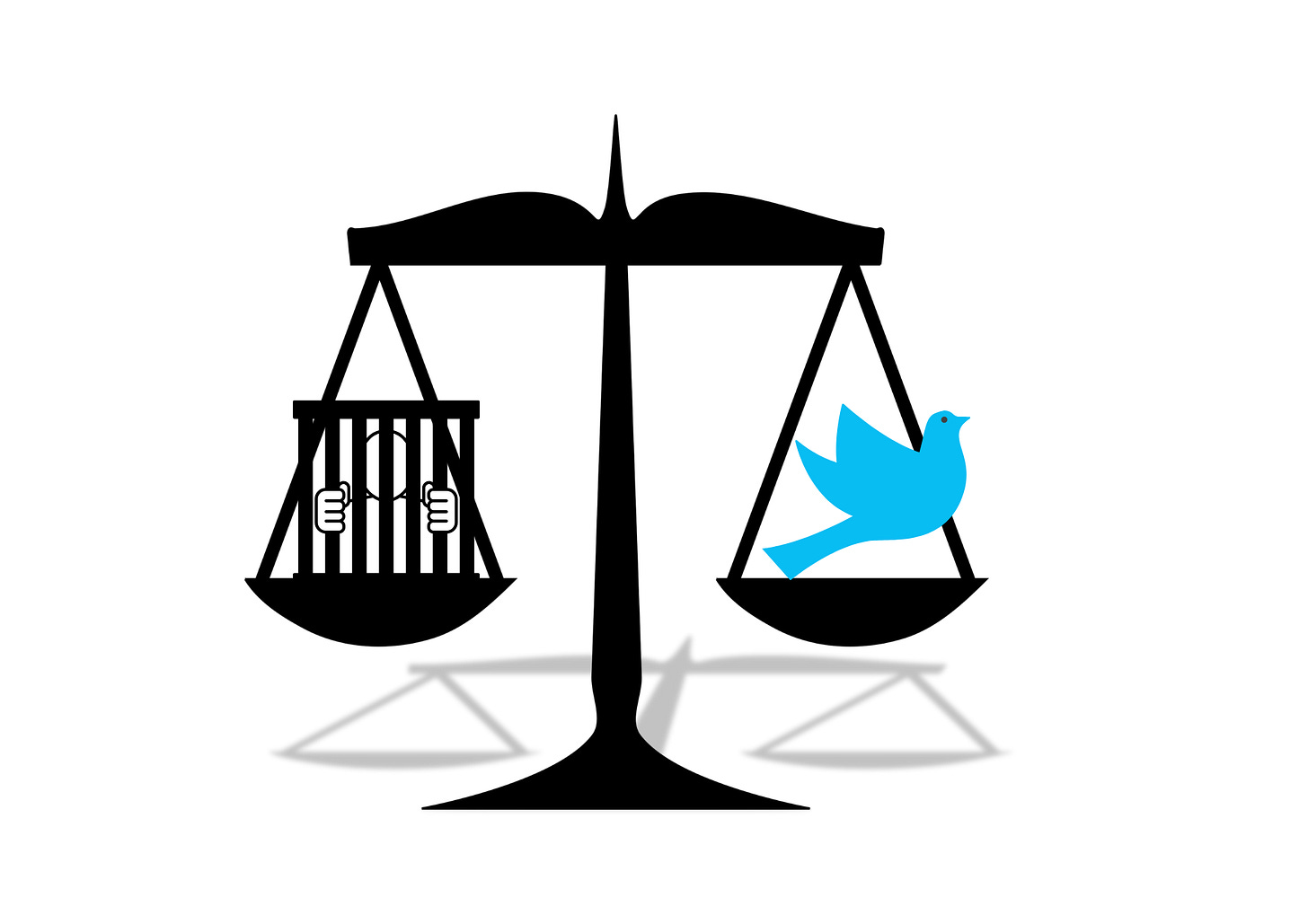

But, it would not be accurate to say that security and freedom are simply opposites; rather, they are more like twin forces that oscillate inside every system, pulling and pushing, and shaping outcomes. Too much of one and not enough of the other can intuitively feel wrong. Just like a scale that can tip too far in either direction, the systems we operate in seem to always be in a scramble for balance.

If we think back to just the middle of the last century, when the Cold War divided the world, nations had discovered that while security can make you feel safe, too much of it could become a trap. During this time, endless stockpiles of nuclear weapons built tight feedback loops of fear, creating a dilemma where one side’s defense became the other’s threat. The end of this period saw the Soviet system collapse and the world transform. That collapse showed that too much security without enough freedom left the system unable to adapt. Later, after the events of 9/11, Western societies once again tipped the scales, sacrificing personal freedoms for protection against unseen risks.

In workplaces and job markets, a similar story has unfolded over time. The loyal Japanese salaryman (サラリーマン) found stability in his work life, but at the cost of creativity. Meanwhile restless Silicon Valley workers who have embraced freedom also discovered job volatility and burnout. Investors also face this same sort of dilemma: bonds offer financial safety but with little growth, equities offer the promise of greater freedom through higher returns but they are also exposed to wild swings in the market. Everywhere, it seems, the same dynamic is played out with political, financial, and workplace systems tugged between the comfort of security and the energy of freedom.

But the more security we build up, the more brittle the systems also become. We have seen many of examples of this quest for certainty across society. Nations have been locked down, employers have demanded loyalty from their employees, and investors have often clung to guarantees. Taken the demand for security to its extreme, we would have maximum security, a prison or police state where rules smother creativity, and feedback is stifled. Yet rigidity leaves us unable to adapt when shocks arrive.

On the other hand, too much freedom has brought chaos, such as financial crises, political instability, and, increasingly today, precarious gig work that leaves people vulnerable without any safety net. Taken to its extreme, this quest for unknown possibility can become aimless drift, characterised by a lack of structure and purpose, where opportunities without anchors leave individuals and systems adrift.

Throughout history, societies and markets have been like an ever-shifting scale, moving in a dynamic equilibrium that constantly adjusts as pressures for security and freedom rise and fall. States have erected walls, only to realise that walls can collapse. Workers have chased flexibility, only to discover that instability also erodes their well-being. Investors have sought higher returns, only to crash and burn when the risks overwhelmed them. Sometimes, it can seem that each attempt to fix one problem can produce unintended consequences later. The seeds of many wars or economic crashes were often sown within what was thought to be the solution to the previous one.

However, the breakthrough came not from choosing one side but from realising the system itself needed redesign. Thinkers in political economy and systems science had reframed the problem by seeing freedom and security not as enemies, but as complementary forces.

In international relations, interdependence through institutions like the European Union has demonstrated that sharing a certain amount of sovereignty could build greater collective stability in the region. Self-interest need not be a zero-sum game.

In career markets, hybrid models such as portable benefits, flexible work, and lifelong upskilling offered a balance of both safety and autonomy. Meanwhile, In the financial markets, diversified portfolios have optimised the tension between risk tolerance and expected returns by balancing assets such as bonds for stability, equities for growth, and property for income generation and inflation protection. In all of these cases, it remains an ongoing process of adaptation, feedback awareness, and redesign.

Looking at it this way, the old debate between Hobbes and Locke has fresh meaning. Hobbes was right: without order, chaos is likely to spread. But Locke was also right: without freedom, systems will stagnate. However, if we could combine our need for secure anchor points with an optimal amount of flexibility, there is a good chance we will become more resilient.